FINANCIAL AID SIMPLIFIED

PREPARE FOR COLLEGE

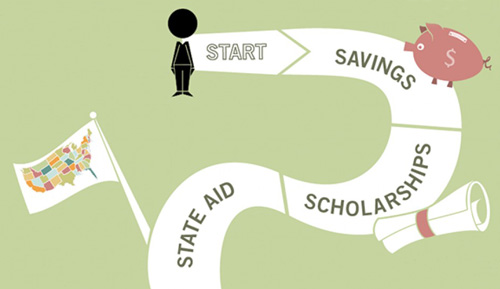

Getting ready for college or career can be easier than you think. Start by defining your goals and interests, understanding college costs, and planning financially and academically. A college education is a long-term investment. With careful planning you can find the school and funding options that work best for your situation and put you on the path to success.

- Begin saving early.

- Scholarships and state aid can help cover the cost of college or career school, but you may find yourself in need of federal assistance.

- Many states have college funding programs. Ask a guidance counselor or your college Financial Services Office for more information.

- Look for scholarships through your state or college as well as national and community organizations.

IT’S TIME TO APPLY FOR FINANCIAL AID

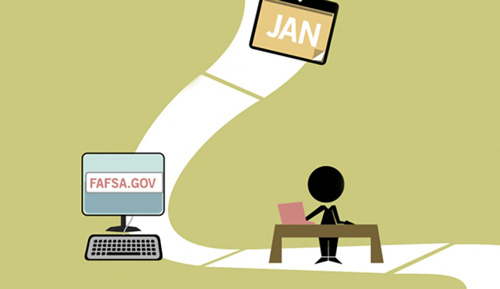

The FAFSA is the Free Application for Federal Student Aid and is the only way to apply for federal student aid. The schools you list on your application will use FAFSA information to evaluate your financial need and determine how much federal aid you are eligible to receive. Many states and colleges also use information from your FAFSA to provide their own financial aid.

Each January, the FAFSA is available for the upcoming school year. It is best to fill it out as early as you can because some aid is first come, first served.

When you complete the FAFSA, you’ll need to provide personal and tax information. If you’ve filed your taxes already, you may be able to automatically retrieve the information from the IRS. If you haven’t, just estimate your tax information and update it later.

Complete the FAFSA online at https://studentaid.gov/. Make sure to fill out and submit the FAFSA each year you are in college.

After you submit your FAFSA, you’ll receive your Student Aid Report (SAR). Your SAR summarizes the information in your FAFSA. Review it and make corrections if needed.

Your FAFSA helps your school determine the types of federal student aid you are eligible to receive.

TYPES OF FEDERAL STUDENT AID

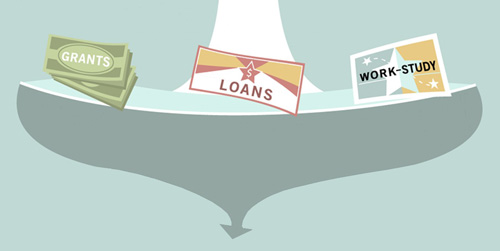

As the largest provider of financial aid, the U.S. Department of Education’s office of Federal Student Aid provides grants, loans, and work-study funds.

- GRANTS: Grants are free money that do not have to be repaid.

- LOANS: Student loans are real loans (like a car or home loan) that need to be repaid with interest.

- WORK-STUDY: A work-study job gives you the opportunity to earn money to help pay your educational expenses.

FINANCIAL AID AWARD

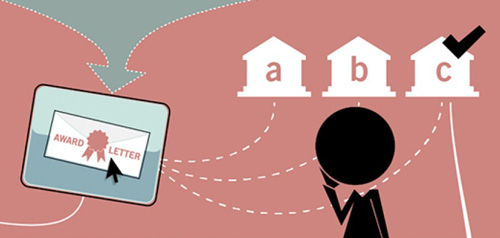

Your award letter explains the combination of federal grants, loans, and work-study a college is offering you. The offer might also contain state and institutional aid. If you receive award letters from multiple colleges, you should compare them and decide which school works best for you.

At Cayuga Community College, financial aid awards are based on need, eligibility, and available funds. First consideration goes to students showing the greatest need. Need is determined by comparing the cost of attending (COA) Cayuga with the expected family contribution (EFC) as calculated by a federal formula. Budgets used for financial aid vary depending upon your status, residency, and program. Standard budgets used for awarding financial aid are available in the Financial Services Office.

PAYMENT OF FINANCIAL AID

Financial aid awards (less any deferred costs) are disbursed to students after the refund period. The Pell award amount will be based on the number of credits you are enrolled in and may be adjusted for course withdrawals even after payment is received.

- Your award check will be mailed to you at the address on file at the Registrar’s Office or deposited to your bank account if you have signed up for direct deposit. Contact the Registrar’s Office if you need to change or correct your address.

- Tuition Assistance Program (TAP) and Aid for Part-Time Study (APTS) awards may be used only for tuition.

- The cost of your tuition, fees and books may be deferred pending actual awards from Federal Direct Loans, Federal Pell Grants, Federal Supplemental Educational Opportunity Grants, and Cayuga Grants and Scholarships.

- Additional aid intended to cover living expenses and transportation will be disbursed after the sixth week of classes. You will need to cover your own living expenses during the first 2 months of school.

- Late Financial Aid, if available, may require up to eight weeks for disbursement.

BEYOND EDUCATION

Once you leave school, you will need to repay your student loans. Contact your loan servicer to discuss repayment options and exit counseling requirements.